American Election 2016 in California

Introduction

Welcome to my data exploration! Through this report, we will have an better insight about 2016 Presidential Campaign Finance 2016. The raw data is collected from website: http://fec.gov/disclosurep/pnational.do

The content of my report is organized by following sections:

-

Univariate Plots Section: multiple plots for individual variables.

-

Univariate Analysis: commment about the univariate finding.

-

Bivariate Plots Section: multiple plots for the relation between two variables

-

Bivariate Analysis: commment about the bivariate finding.

-

Multivariate Plots Section: multiple plots for the relation between three and more variables.

-

Multivariate Analysis: commment about the multivariate finding

-

Final Plots and Summary

-

Reflection

library(ggplot2)

library(ggthemes)

library(gridExtra)

library(dplyr)

library(plotly)

library(grid)

library(DT)

library(GGally)

library(psych)

Data structure

pf <- read.csv('P00000001-CA.csv')

pf$contbr_occupation[pf$contbr_occupation == "INFORMATION REQUESTED PER BEST EFFORTS"] <- "INFORMATION REQUESTED"

names(pf)

dim(pf)

str(pf)

pf_sample <- pf #using whole dataset

## [1] "cmte_id" "cand_id" "cand_nm"

## [4] "contbr_nm" "contbr_city" "contbr_st"

## [7] "contbr_zip" "contbr_employer" "contbr_occupation"

## [10] "contb_receipt_amt" "contb_receipt_dt" "receipt_desc"

## [13] "memo_cd" "memo_text" "form_tp"

## [16] "file_num" "tran_id" "election_tp"

## [19] "X"

## [1] 1040672 19

## 'data.frame': 1040672 obs. of 19 variables:

## $ cmte_id : Factor w/ 25 levels "C00458844","C00500587",..: 6 6 6 7 7 7 7 6 7 7 ...

## $ cand_id : Factor w/ 25 levels "P00003392","P20002671",..: 1 1 1 12 12 12 12 1 12 12 ...

## $ cand_nm : Factor w/ 25 levels "Bush, Jeb","Carson, Benjamin S.",..: 4 4 4 20 20 20 20 4 20 20 ...

## $ contbr_nm : Factor w/ 184410 levels " ALERIS, ANNAKIM",..: 6157 25050 55765 94017 95179 95179 95205 73475 95222 95242 ...

## $ contbr_city : Factor w/ 2077 levels "","-4086",".",..: 927 257 596 256 1476 1476 1965 891 2017 1349 ...

## $ contbr_st : Factor w/ 1 level "CA": 1 1 1 1 1 1 1 1 1 1 ...

## $ contbr_zip : Factor w/ 127038 levels "","00000","000090272",..: 101631 63495 47311 58650 15247 15247 40310 51776 54670 102865 ...

## $ contbr_employer : Factor w/ 54940 levels ""," APPLE INC.",..: 32438 32438 32438 3754 52045 52045 34655 32438 33559 42685 ...

## $ contbr_occupation: Factor w/ 24164 levels ""," ATTORNEY",..: 18087 18087 18087 20209 15150 15150 16579 18087 14018 6202 ...

## $ contb_receipt_amt: num 50 200 5 40 35 100 25 40 10 15 ...

## $ contb_receipt_dt : Factor w/ 640 levels "01-APR-15","01-APR-16",..: 521 389 24 75 95 116 75 389 95 116 ...

## $ receipt_desc : Factor w/ 74 levels "","* EARMARKED CONTRIBUTION: SEE BELOW REATTRIBUTION/REFUND PENDING",..: 1 1 1 1 1 1 1 1 1 1 ...

## $ memo_cd : Factor w/ 2 levels "","X": 2 2 2 1 1 1 1 2 1 1 ...

## $ memo_text : Factor w/ 360 levels "","*","* $550 REFUNDED 6/16/16",..: 37 37 37 4 4 4 4 37 4 4 ...

## $ form_tp : Factor w/ 3 levels "SA17A","SA18",..: 2 2 2 1 1 1 1 2 1 1 ...

## $ file_num : int 1091718 1091718 1091718 1077404 1077404 1077404 1077404 1091718 1077404 1077404 ...

## $ tran_id : Factor w/ 1037291 levels "A000771210424405B8CF",..: 247724 247006 244388 773763 775207 777508 773225 247044 775203 778420 ...

## $ election_tp : Factor w/ 4 levels "","G2016","P2016",..: 3 3 3 3 3 3 3 3 3 3 ...

## $ X : logi NA NA NA NA NA NA ...

In summary, this dataset has more than 1 million observations. This is quite a big data that can help me to know about the financial contribution of voters in California area during American Election 2016. Each observation contains 19 variables with multiple ordered factors. There is only 1 numeric variable, the amount of contribution or “contb_receipt_amt”.

1. Univariate Plots Section

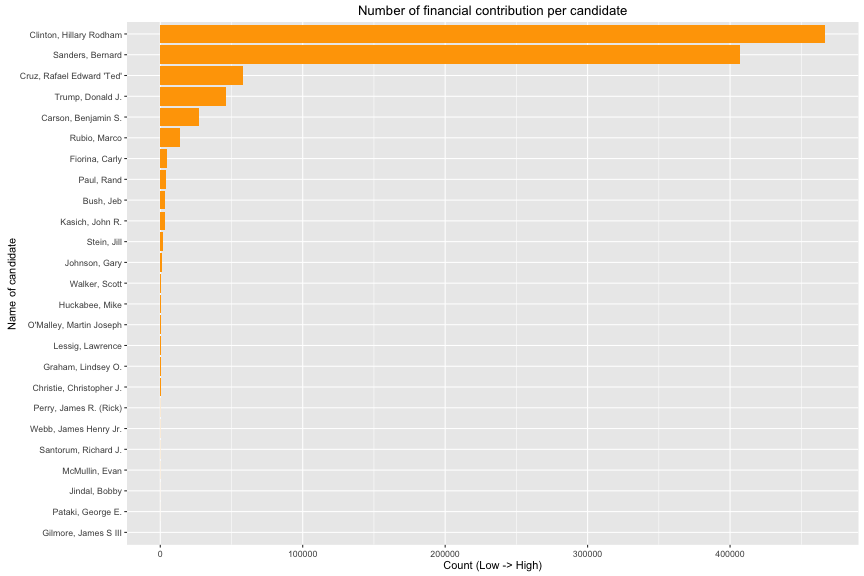

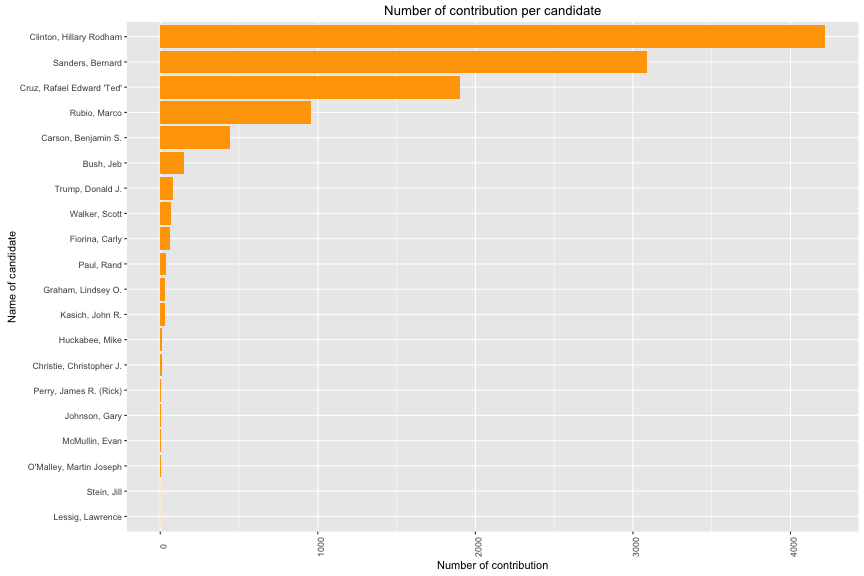

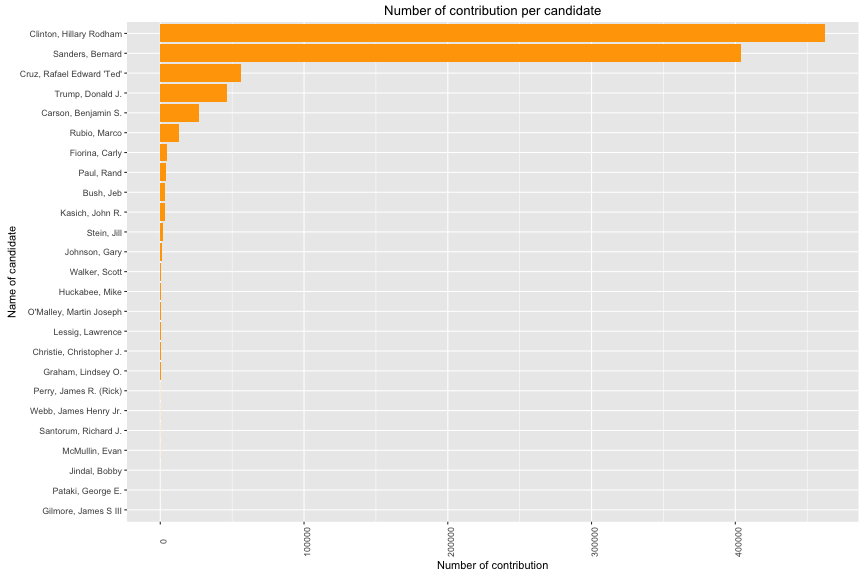

In the horizontal bar chart above, it is not uniform distribution. Number of contribution mainly go to Hilary Clinton or Bernard Sanders in CA. How is the distribution of money from contributors ?

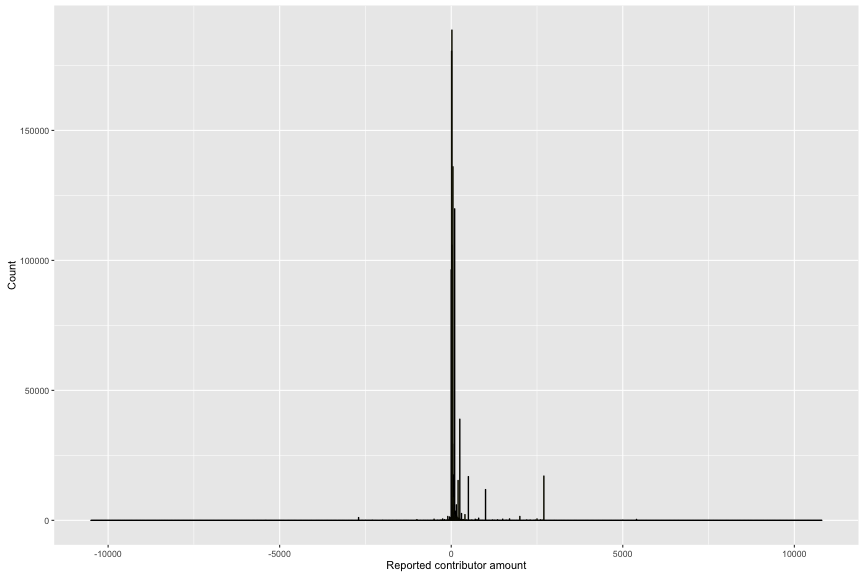

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -10500.0 15.0 27.0 123.1 87.5 10800.0

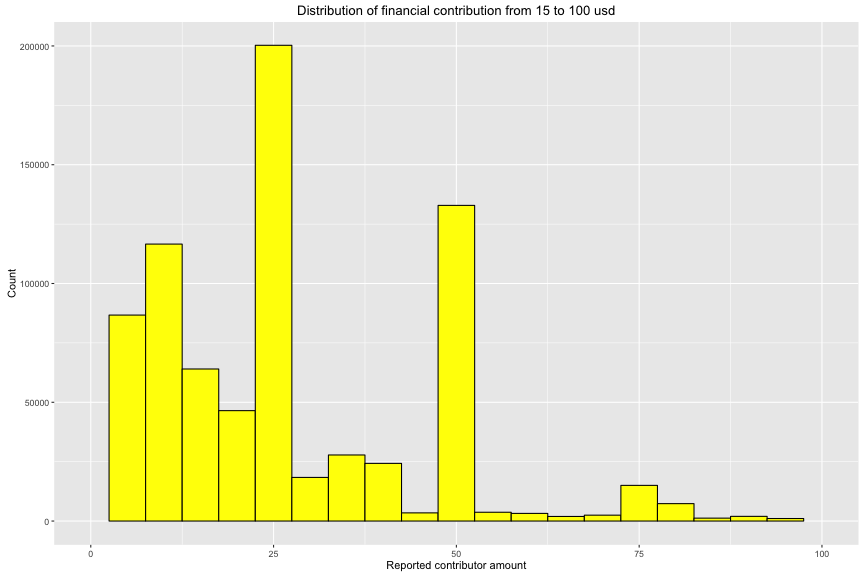

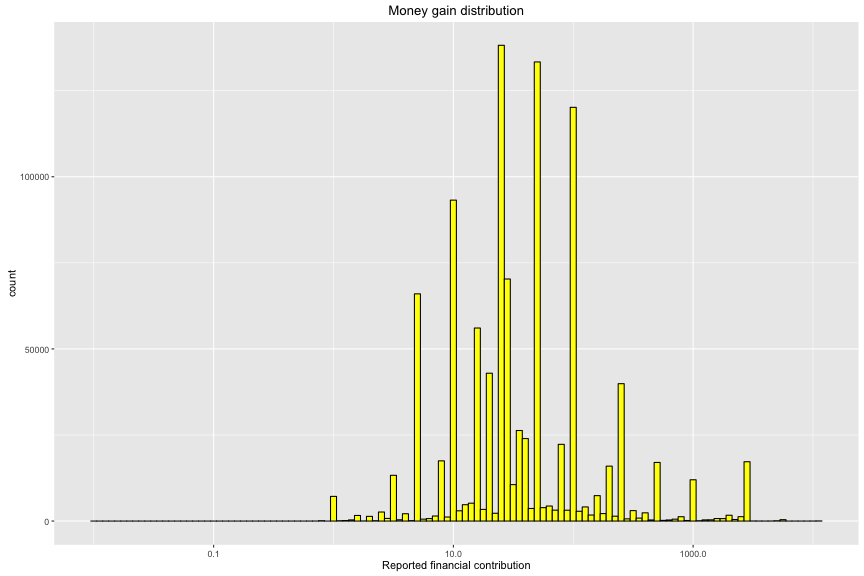

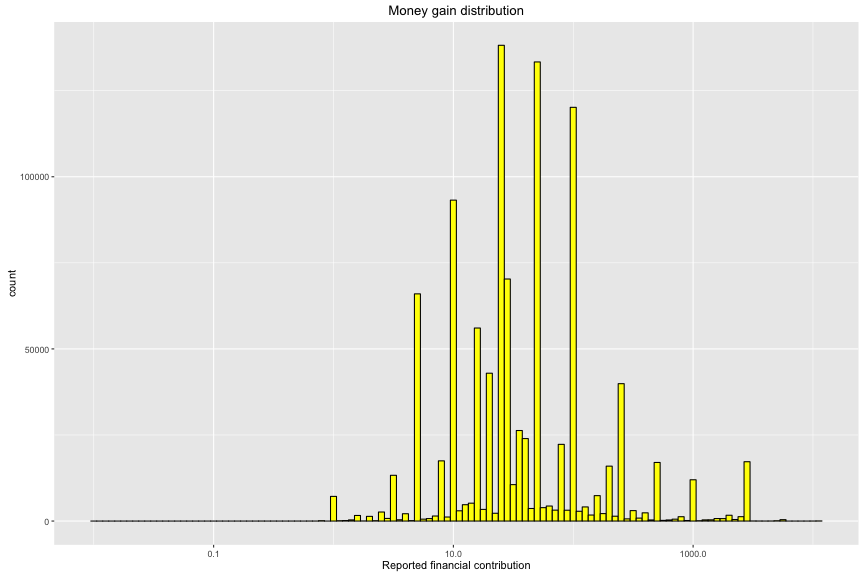

There is 75% of contribution that is from 15 usd to 87.5 usd to their candidates. In order to have better observation, I plotted the money contribution in range between 15 to 100 usd.

The peak is 25 usd/contribution. Through the summary of financial contribution, there are negative and positive money. The positive is the money to candidate fund and the negative is the money out of candidate fund. So, I seperate this variable into 2 subsets. By doing this, I will have better comparison to determine who win and lose in fund raising in this American Election 2016.

1.1. Positive Contribution

Let’s start with the positive subset. How is the contribution in this group ?

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.01 15.00 27.00 130.50 96.50 10800.00

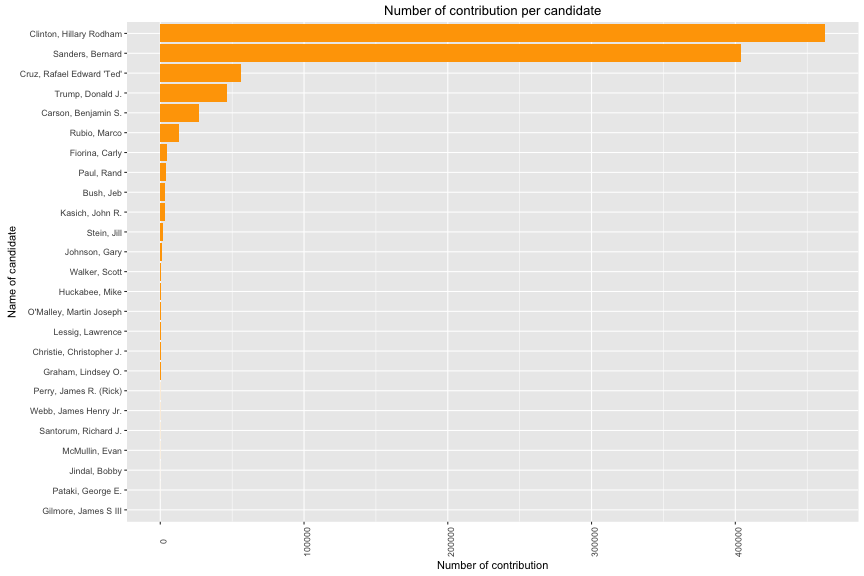

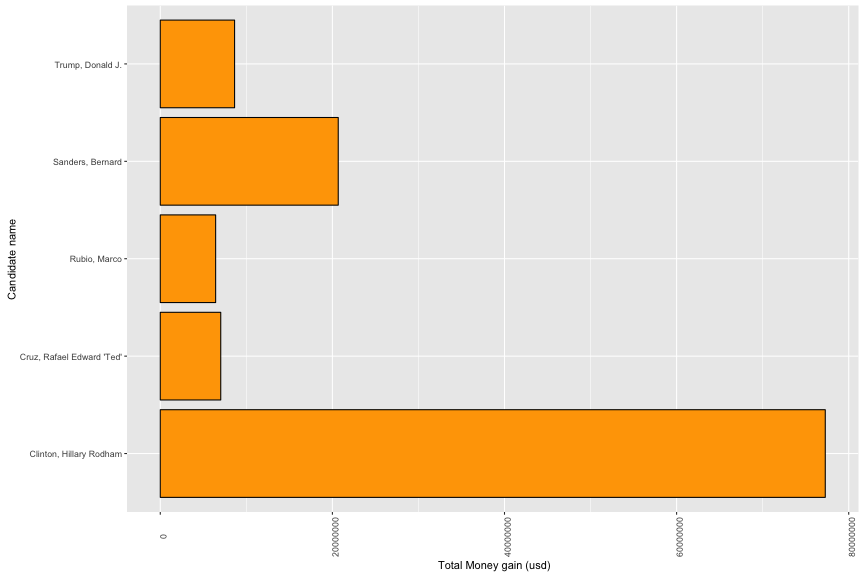

Top 5 candidates that get the largest contribution are Hilary Clinton, Bernard Sanders, Rafael “TED” Cruz, Donald Trump and Benjamin Carson respectively. However, Hilary Clinton and Bernard Sanders have large dominant positions. On the other hand, the money per contribution is very diversed and I have to use log10() function to display this distribution. The median is at 27 usd and 75% is from 15 to 130.5 usd. There are outliers with max at 10,800 usd.

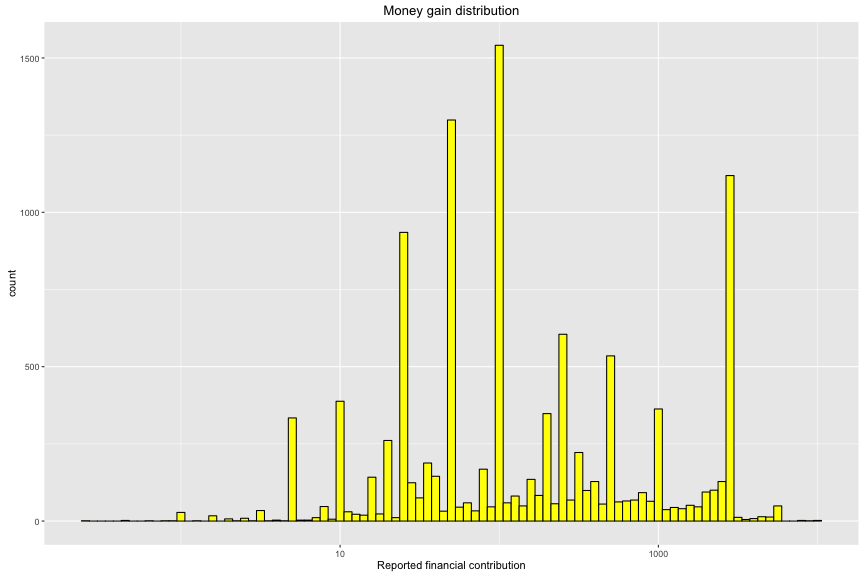

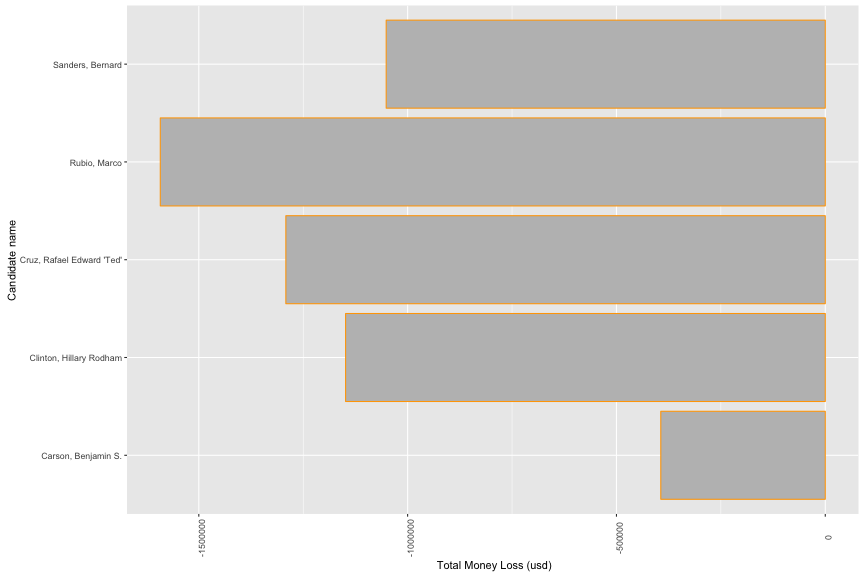

1.2. Negative Contribution

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -10500.00 -500.00 -100.00 -565.50 -38.00 -0.24

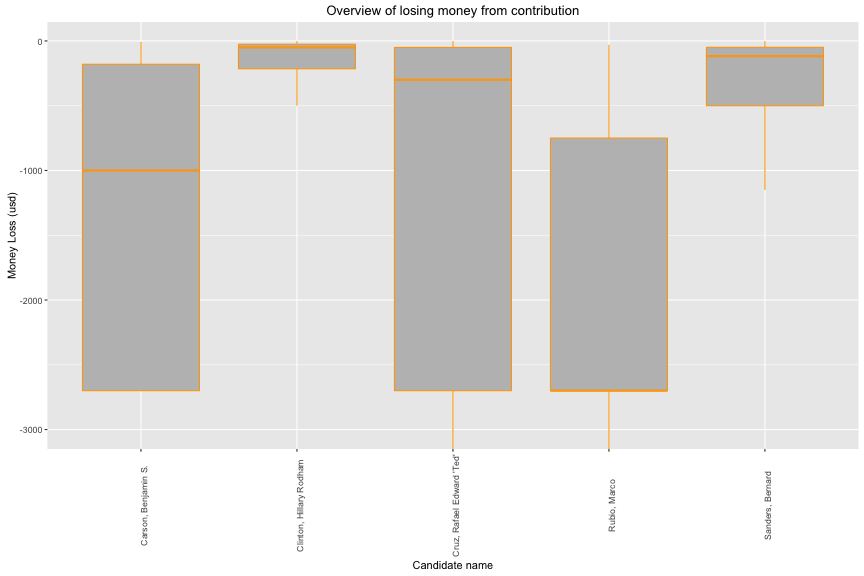

In contrast group, top 5 candidates that get largest number of negative contribution are Hilary Clinton, Bernard Sanders, Rafael “TED” Cruz, Marco Rubio and Benjamin Carson. Except Donald Trump, the top 4 candidates have highest postive contribution and also have highest negative contribution during this American Election in CA. In study of money per contribution, the median is - 100 usd and 75% is from -38 to -500 usd. The minimum is at -10,500 usd.

2. Univariate Analysis

What is the structure of your dataset?

There are 1,040,672 observations in the dataset with 19 variables. Except ‘contb_receipt_amt’, other features are ordered by factor variables with many levels.

## 'data.frame': 1040672 obs. of 19 variables:

## $ cmte_id : Factor w/ 25 levels "C00458844","C00500587",..: 6 6 6 7 7 7 7 6 7 7 ...

## $ cand_id : Factor w/ 25 levels "P00003392","P20002671",..: 1 1 1 12 12 12 12 1 12 12 ...

## $ cand_nm : Factor w/ 25 levels "Bush, Jeb","Carson, Benjamin S.",..: 4 4 4 20 20 20 20 4 20 20 ...

## $ contbr_nm : Factor w/ 184410 levels " ALERIS, ANNAKIM",..: 6157 25050 55765 94017 95179 95179 95205 73475 95222 95242 ...

## $ contbr_city : Factor w/ 2077 levels "","-4086",".",..: 927 257 596 256 1476 1476 1965 891 2017 1349 ...

## $ contbr_st : Factor w/ 1 level "CA": 1 1 1 1 1 1 1 1 1 1 ...

## $ contbr_zip : Factor w/ 127038 levels "","00000","000090272",..: 101631 63495 47311 58650 15247 15247 40310 51776 54670 102865 ...

## $ contbr_employer : Factor w/ 54940 levels ""," APPLE INC.",..: 32438 32438 32438 3754 52045 52045 34655 32438 33559 42685 ...

## $ contbr_occupation: Factor w/ 24164 levels ""," ATTORNEY",..: 18087 18087 18087 20209 15150 15150 16579 18087 14018 6202 ...

## $ contb_receipt_amt: num 50 200 5 40 35 100 25 40 10 15 ...

## $ contb_receipt_dt : Factor w/ 640 levels "01-APR-15","01-APR-16",..: 521 389 24 75 95 116 75 389 95 116 ...

## $ receipt_desc : Factor w/ 74 levels "","* EARMARKED CONTRIBUTION: SEE BELOW REATTRIBUTION/REFUND PENDING",..: 1 1 1 1 1 1 1 1 1 1 ...

## $ memo_cd : Factor w/ 2 levels "","X": 2 2 2 1 1 1 1 2 1 1 ...

## $ memo_text : Factor w/ 360 levels "","*","* $550 REFUNDED 6/16/16",..: 37 37 37 4 4 4 4 37 4 4 ...

## $ form_tp : Factor w/ 3 levels "SA17A","SA18",..: 2 2 2 1 1 1 1 2 1 1 ...

## $ file_num : int 1091718 1091718 1091718 1077404 1077404 1077404 1077404 1091718 1077404 1077404 ...

## $ tran_id : Factor w/ 1037291 levels "A000771210424405B8CF",..: 247724 247006 244388 773763 775207 777508 773225 247044 775203 778420 ...

## $ election_tp : Factor w/ 4 levels "","G2016","P2016",..: 3 3 3 3 3 3 3 3 3 3 ...

## $ X : logi NA NA NA NA NA NA ...

What is/are the main feature(s) of interest in your dataset ?

The main features in this dataset are contb_receipt_amt (CONTRIBUTION RECEIPT AMOUNT) and cand_nm (CANDIDATE NAME). I would like to know the financial support of each candidate in this AMERiCAN ELECTION 2016. My idea is that I can make a prediction about the financial contribution based on other features.

What other features in the dataset do you think will help support your investigation into your feature(s) of interest?

Name of city, occupation, candidate name likely contribute to the financial support.

Did you create any new variables from existing variables in the dataset?

Currently I do not make new variable for univariate analysis. I found that it is not necessary to find new variable while I only have 1 numeric variable (contb_receipt_amt) and the rest is catergory variables.

Of the features you investigated, were there any unusual distributions? Did you perform any operations on the data to tidy, adjust, or change the form of the data? If so, why did you do this?

I encountered with the positive and negative sign in financial contribution. Therefore, I created two dataset which contains only positive or negative support. It help me to have a good overview of money raising and losing for each candidate. I used log_10 tranformation to study about the financial support because its distribution is very skewed.

In positive support, contribution tends to give money at some fixed amount with a highest count around 50euro . So is negative support, the highest count is at 100 euro.

3. Bivariate Plots Section

Firstly, I extract information of some outliers from financial contribution.

3.1. Top contributors

3.1a. Positive contributor

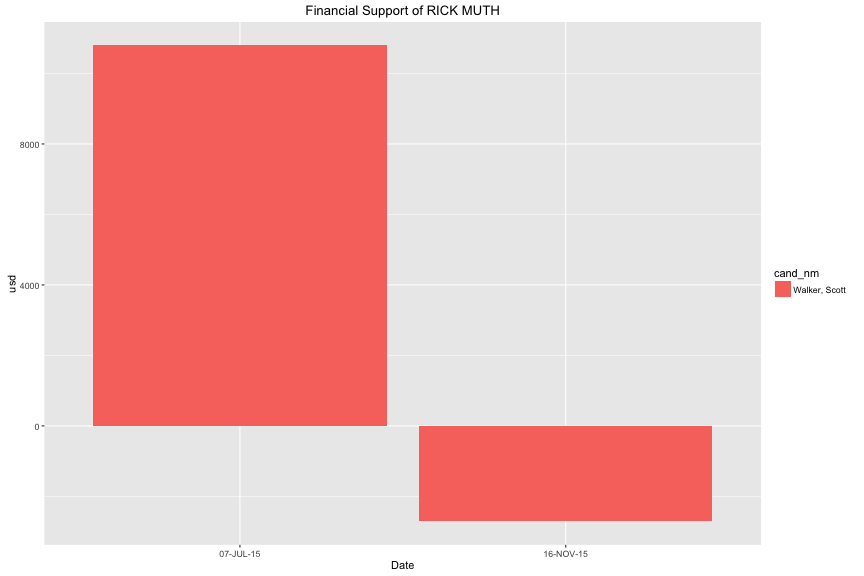

## cand_nm contbr_nm contbr_zip

## 8950 Walker, Scott MUTH, RICK 90680

Scott Walker is the one who received the biggest money from contributor Rick Mut with 10,800.

## cand_nm contbr_nm contbr_zip contb_receipt_amt

## 8950 Walker, Scott MUTH, RICK 90680 10800

## 8951 Walker, Scott MUTH, RICK 90680 -5400

## 8952 Walker, Scott MUTH, RICK 90680 -2700

## 8953 Walker, Scott MUTH, RICK 90680 2700

## 988004 Walker, Scott MUTH, RICK 90680 -2700

## contb_receipt_dt receipt_desc

## 8950 07-JUL-15

## 8951 07-JUL-15

## 8952 07-JUL-15

## 8953 07-JUL-15

## 988004 16-NOV-15 Refund

## [1] 2700

On 7-Jul, he contributed 10,800 usd. Later, he withrawed 8,100 usd then put in 2,700 usd again. After 4 month, he got back 2,700 usd. In final, he only contributed 2,700 usd to Scott Walker for this American Election.

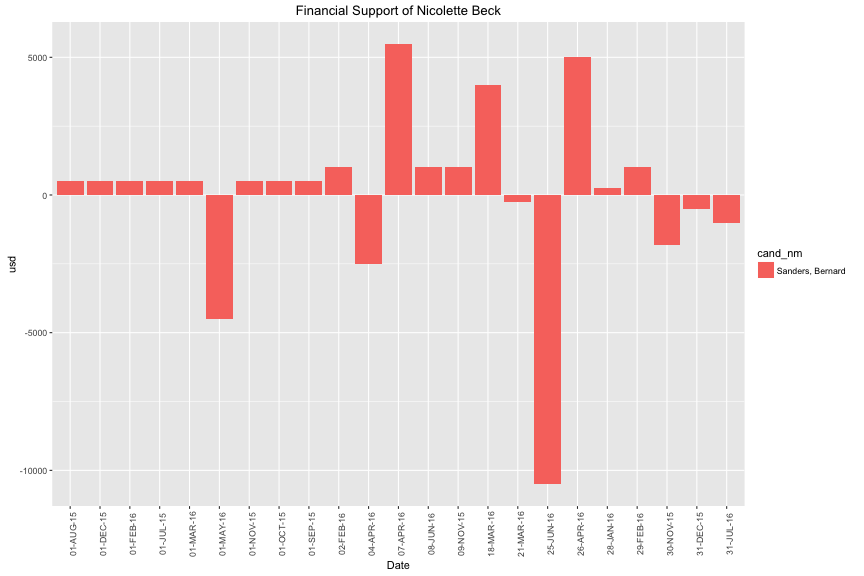

3.1b. Negative contributor

## cand_nm contbr_nm contbr_zip

## 583633 Sanders, Bernard BECK, NICOLETTE 941103415

The maximum money loss is 10,500 usd. Bernard Sanders is the one who lost largest money from contributor Nicolette Beck.

## cand_nm contbr_nm contbr_zip contb_receipt_amt

## 10027 Sanders, Bernard BECK, NICOLETTE 941103415 500

## 14098 Sanders, Bernard BECK, NICOLETTE 941103415 500

## 38866 Sanders, Bernard BECK, NICOLETTE 941103415 500

## 61705 Sanders, Bernard BECK, NICOLETTE 941103415 5000

## 61706 Sanders, Bernard BECK, NICOLETTE 941103415 500

## 62974 Sanders, Bernard BECK, NICOLETTE 941103415 5000

## 106271 Sanders, Bernard BECK, NICOLETTE 941103415 500

## 130294 Sanders, Bernard BECK, NICOLETTE 941103415 -1800

## 131806 Sanders, Bernard BECK, NICOLETTE 941103415 -500

## 134337 Sanders, Bernard BECK, NICOLETTE 941103415 -250

## 158593 Sanders, Bernard BECK, NICOLETTE 941103415 -1000

## 206357 Sanders, Bernard BECK, NICOLETTE 941103415 500

## 352369 Sanders, Bernard BECK, NICOLETTE 941103415 500

## 361793 Sanders, Bernard BECK, NICOLETTE 941103415 250

## 379907 Sanders, Bernard BECK, NICOLETTE 941103415 1000

## 415093 Sanders, Bernard BECK, NICOLETTE 941103415 1000

## 437263 Sanders, Bernard BECK, NICOLETTE 941103415 4000

## 583633 Sanders, Bernard BECK, NICOLETTE 941103415 -10500

## 771202 Sanders, Bernard BECK, NICOLETTE 941103415 1000

## 783502 Sanders, Bernard BECK, NICOLETTE 941103415 1000

## 849788 Sanders, Bernard BECK, NICOLETTE 941103415 500

## 870541 Sanders, Bernard BECK, NICOLETTE 941103415 500

## 918846 Sanders, Bernard BECK, NICOLETTE 941103415 -4500

## 998664 Sanders, Bernard BECK, NICOLETTE 941103415 -2500

## contb_receipt_dt

## 10027 01-AUG-15

## 14098 01-SEP-15

## 38866 01-FEB-16

## 61705 07-APR-16

## 61706 07-APR-16

## 62974 26-APR-16

## 106271 01-JUL-15

## 130294 30-NOV-15

## 131806 31-DEC-15

## 134337 21-MAR-16

## 158593 31-JUL-16

## 206357 01-DEC-15

## 352369 01-NOV-15

## 361793 28-JAN-16

## 379907 29-FEB-16

## 415093 09-NOV-15

## 437263 18-MAR-16

## 583633 25-JUN-16

## 771202 02-FEB-16

## 783502 08-JUN-16

## 849788 01-OCT-15

## 870541 01-MAR-16

## 918846 01-MAY-16

## 998664 04-APR-16

## receipt_desc

## 10027

## 14098

## 38866 * EARMARKED CONTRIBUTION: SEE BELOW REATTRIBUTION/REFUND PENDING

## 61705

## 61706

## 62974

## 106271

## 130294 Refund

## 131806 Refund

## 134337 Refund

## 158593 Refund

## 206357

## 352369

## 361793

## 379907 * EARMARKED CONTRIBUTION: SEE BELOW REATTRIBUTION/REFUND PENDING

## 415093

## 437263

## 583633 Refund

## 771202 * EARMARKED CONTRIBUTION: SEE BELOW REATTRIBUTION/REFUND PENDING

## 783502

## 849788

## 870541

## 918846 Refund

## 998664 Refund

## [1] 1700

Morover, the interesting point is that this contributor did transaction to Bernard Sanders in multiple times. At last, the money for Bernard Sanders from this contributor is 1,700 usd in total.

3.2. Financial Support vs other features of interest

Since I have 18 features ordered by factor variables and the number of factors in my interested variables are large. It would be wise to make additional selections for each variables.

## Factor w/ 25 levels "Bush, Jeb","Carson, Benjamin S.",..: 4 4 4 20 20 20 20 4 20 20 ...

## Factor w/ 2077 levels "","-4086",".",..: 927 257 596 256 1476 1476 1965 891 2017 1349 ...

## Factor w/ 24164 levels ""," ATTORNEY",..: 18087 18087 18087 20209 15150 15150 16579 18087 14018 6202 ...

## Source: local data frame [5 x 1]

##

## cand_nm

## <fctr>

## 1 Rubio, Marco

## 2 Cruz, Rafael Edward 'Ted'

## 3 Clinton, Hillary Rodham

## 4 Sanders, Bernard

## 5 Carson, Benjamin S.

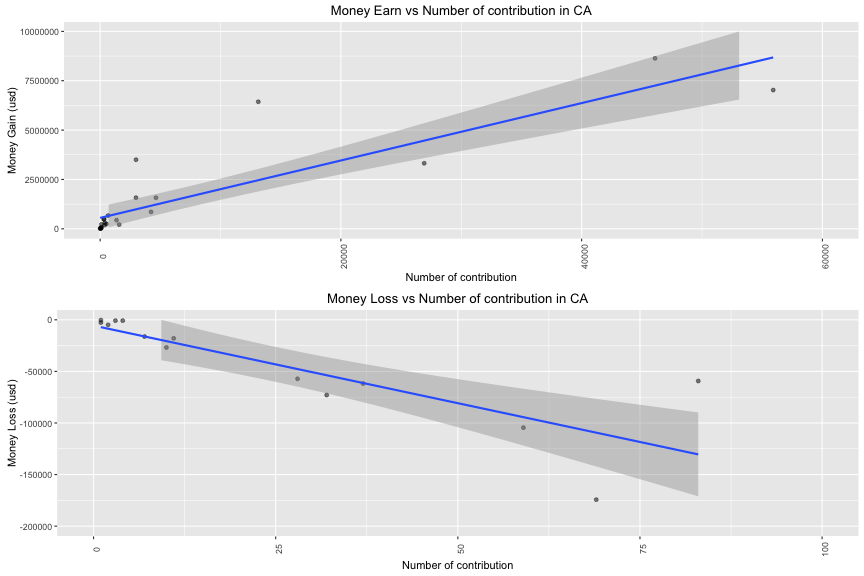

In money gain:

##

## Call:

## lm(formula = Money ~ Count, data = by_cand_nm_p)

##

## Coefficients:

## (Intercept) Count

## 596730 116

##

## Pearson's product-moment correlation

##

## data: by_cand_nm_p$Money and by_cand_nm_p$Count

## t = 9.067, df = 23, p-value = 0.000000004692

## alternative hypothesis: true correlation is not equal to 0

## 95 percent confidence interval:

## 0.7512196 0.9479820

## sample estimates:

## cor

## 0.8839635

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 8100 188800 482900 5373000 3318000 77270000

In money loss:

##

## Call:

## lm(formula = Money ~ Count, data = by_cand_nm_m)

##

## Coefficients:

## (Intercept) Count

## -125217.1 -339.9

##

## Pearson's product-moment correlation

##

## data: by_cand_nm_m$Money and by_cand_nm_m$Count

## t = -5.31, df = 18, p-value = 0.0000477

## alternative hypothesis: true correlation is not equal to 0

## 95 percent confidence interval:

## -0.9093826 -0.5177217

## sample estimates:

## cor

## -0.781255

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -1592000 -247900 -60540 -313900 -13390 -300

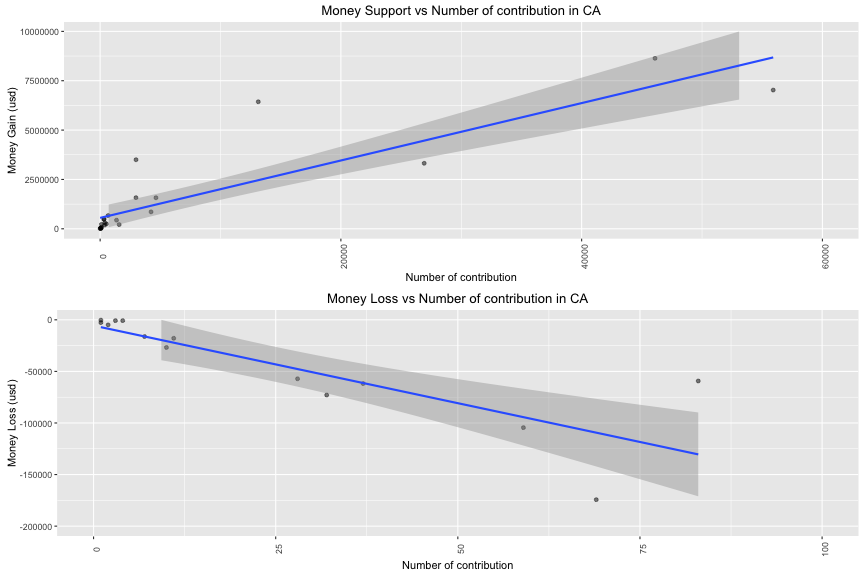

As number of contributions increases, the amount of money increases. This phenomenan happens in both money gain and money loss. The relationship between contributions and money apprers to be linear.

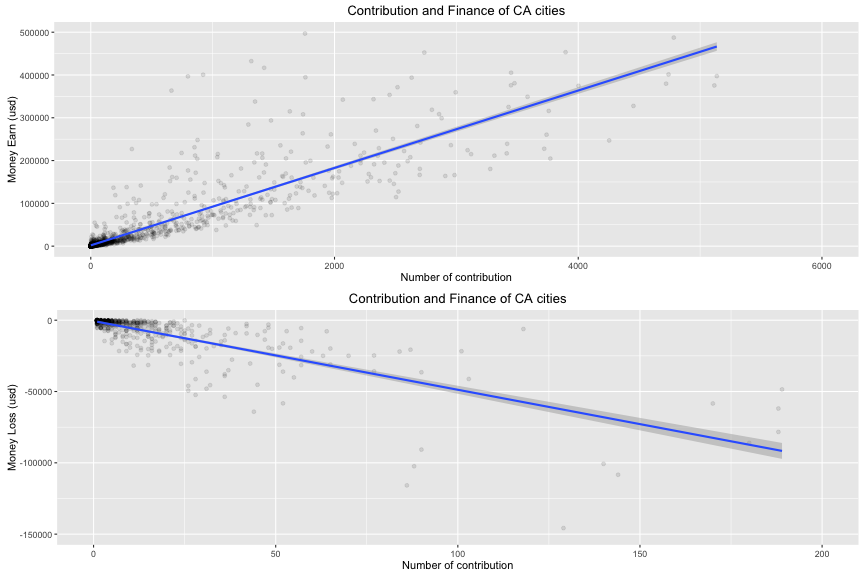

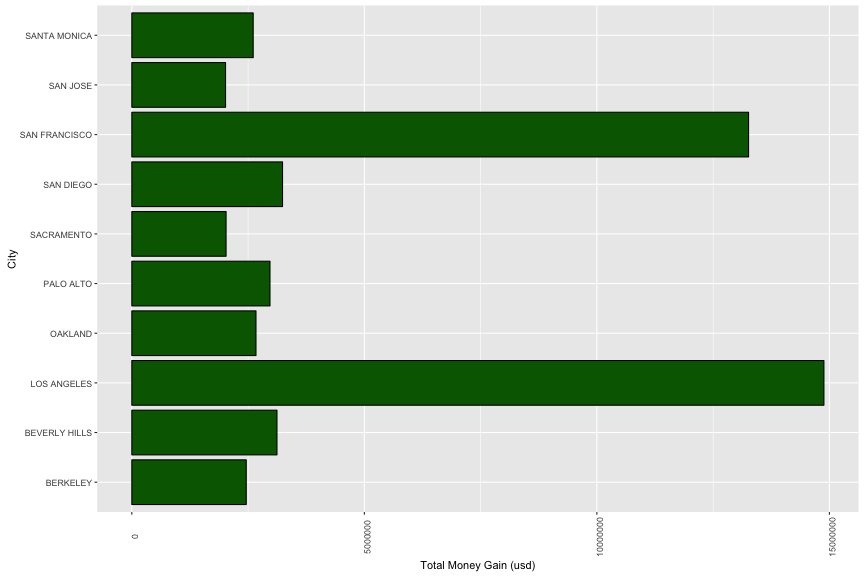

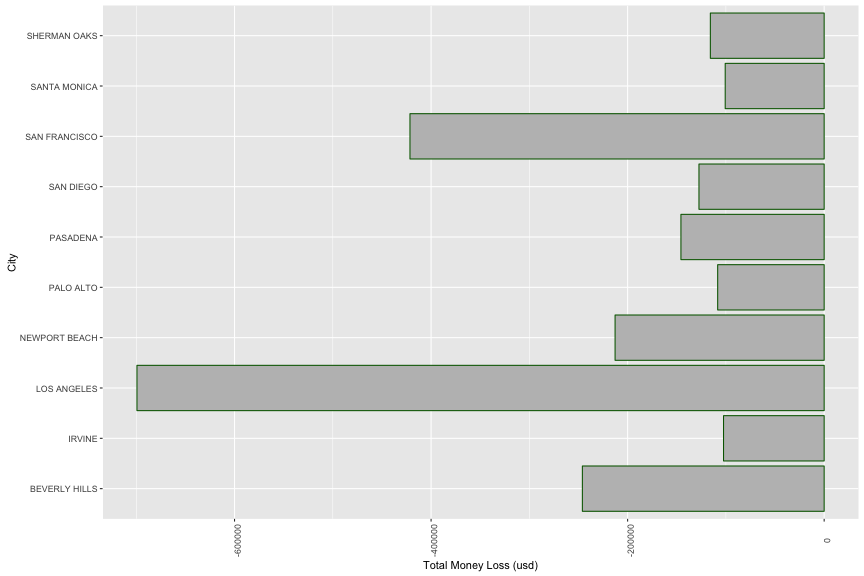

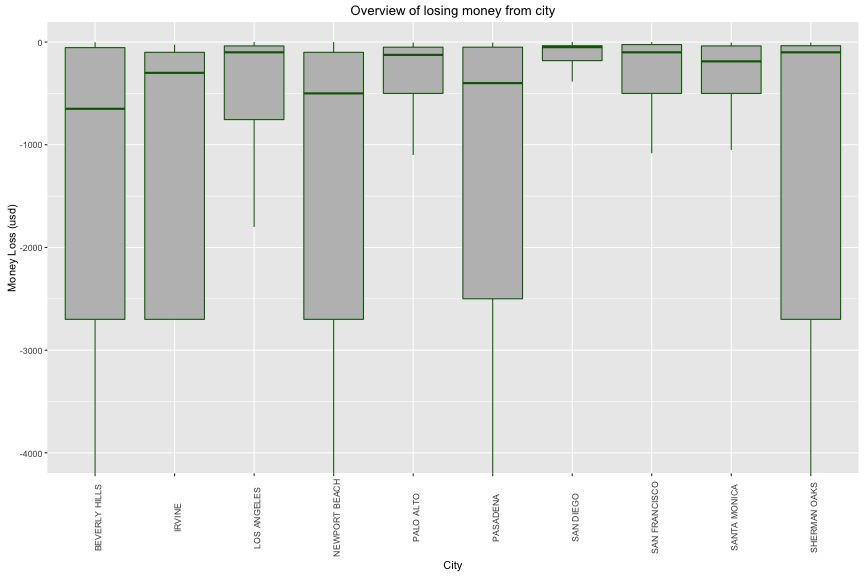

Next, I observe the financial contribution and amount of money related to cities in LA.

In money gain:

##

## Call:

## lm(formula = Money ~ Count, data = by_cities_p)

##

## Coefficients:

## (Intercept) Count

## -16410.7 163.5

##

## Pearson's product-moment correlation

##

## data: by_cities_p$Money and by_cities_p$Count

## t = 142.59, df = 2069, p-value < 0.00000000000000022

## alternative hypothesis: true correlation is not equal to 0

## 95 percent confidence interval:

## 0.9485547 0.9565243

## sample estimates:

## cor

## 0.952703

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 2 230 1827 64870 16020 14880000

In money loss:

##

## Call:

## lm(formula = Money ~ Count, data = by_cities_m)

##

## Coefficients:

## (Intercept) Count

## 1287.6 -637.3

##

## Pearson's product-moment correlation

##

## data: by_cities_m$Money and by_cities_m$Count

## t = -57.418, df = 617, p-value < 0.00000000000000022

## alternative hypothesis: true correlation is not equal to 0

## 95 percent confidence interval:

## -0.9293844 -0.9044072

## sample estimates:

## cor

## -0.917799

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -699300 -7386 -1926 -10140 -450 -10

I have a high correlation between number of contribution and money gain per city. The city which has high number of contribution likely has high financial support for the election. Moreover, 75% of cities have contributed from 230 usd to 1827 usd (the median = 1827, the max = 14 millions). On the other side, money loss is larger when the number of contribution increases. There is 75% of cities which have money loss from 7,000 usd to 10,000 usd (the median = 1926 usd and the max = ~700,000 usd)

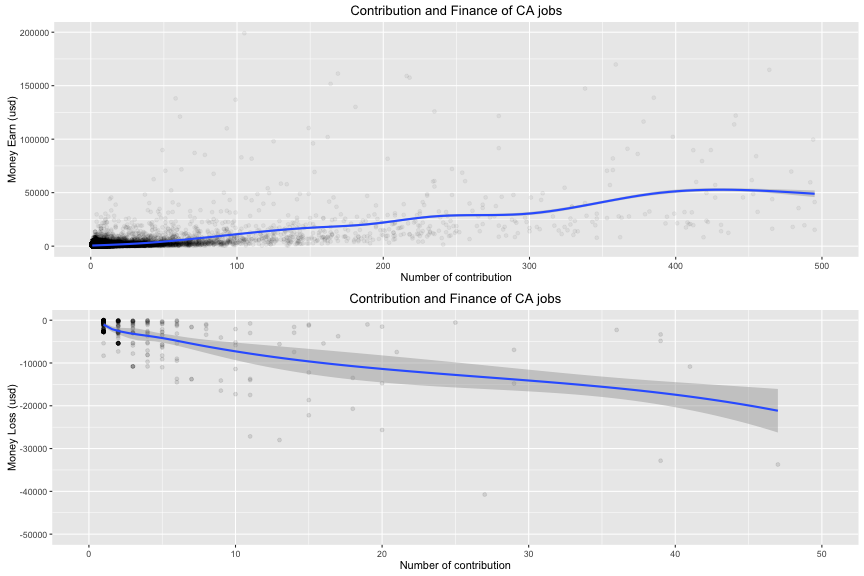

In money gain:

##

## Call:

## lm(formula = Money ~ Count, data = by_occupation_p)

##

## Coefficients:

## (Intercept) Count

## 1326.99 99.34

##

## Pearson's product-moment correlation

##

## data: by_occupation_p$Money and by_occupation_p$Count

## t = 382.79, df = 24160, p-value < 0.00000000000000022

## alternative hypothesis: true correlation is not equal to 0

## 95 percent confidence interval:

## 0.9247222 0.9282923

## sample estimates:

## cor

## 0.9265281

## Min. 1st Qu. Median Mean 3rd Qu. Max.

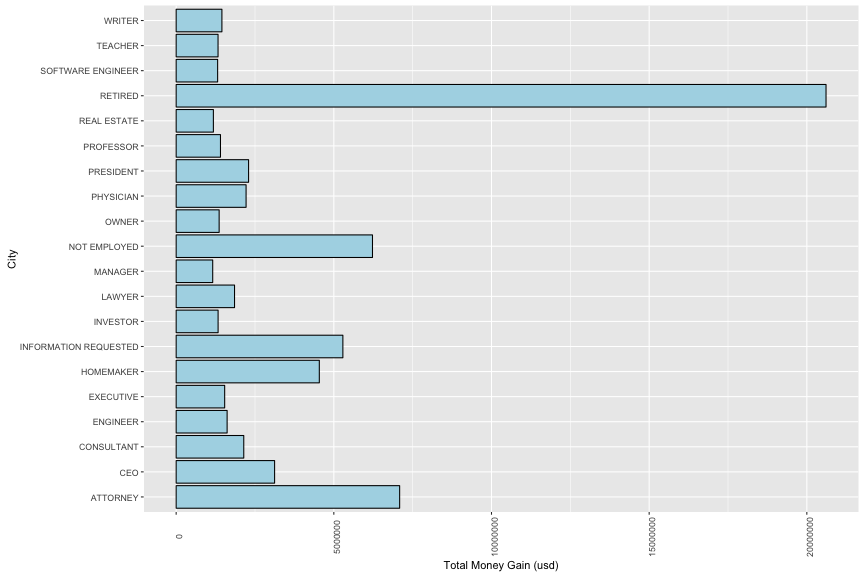

## 1 125 315 5560 1000 20610000

In money loss:

##

## Call:

## lm(formula = Money ~ Count, data = by_occupation_m)

##

## Coefficients:

## (Intercept) Count

## -2321.5 -472.6

##

## Pearson's product-moment correlation

##

## data: by_occupation_m$Money and by_occupation_m$Count

## t = -339.42, df = 442, p-value < 0.00000000000000022

## alternative hypothesis: true correlation is not equal to 0

## 95 percent confidence interval:

## -0.9984126 -0.9976950

## sample estimates:

## cor

## -0.9980872

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -3708000 -2954 -1290 -14140 -200 -1

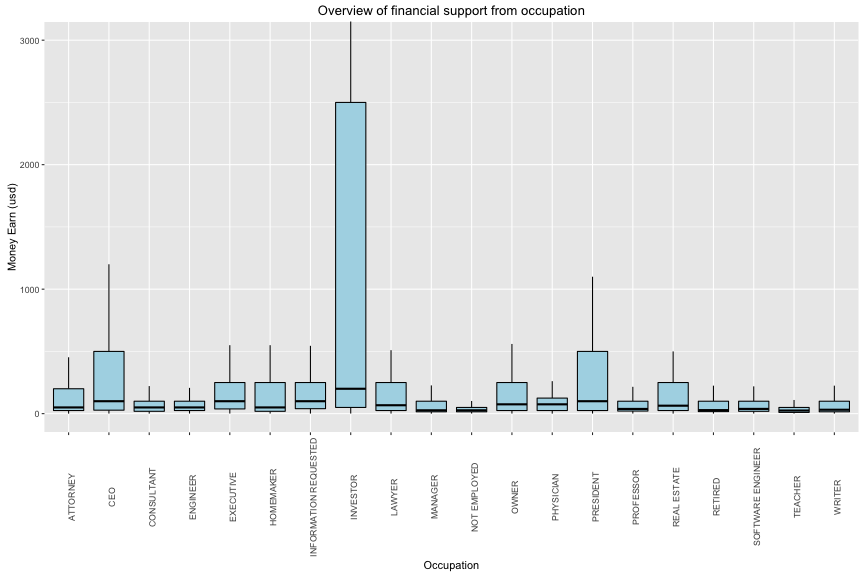

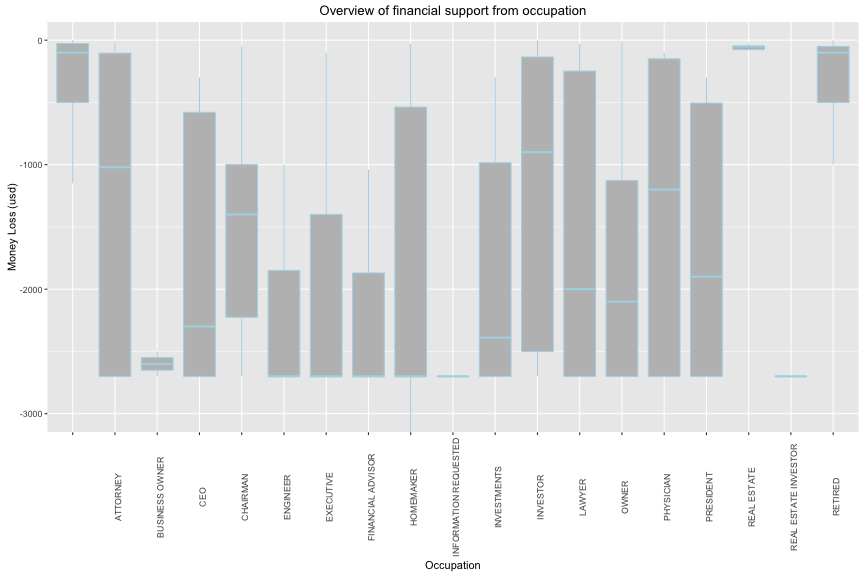

It states that the amount of money highly related to the number of contribution per job (the median = 315 usd and the max = 20 millions usd ). This pattern appears in the negative support too (the median = 1290 usd and the max = 3.7 millions).

For extra bivariate plots, I explored the financial support of contributors in two subsets that have those features:

-

In top 5 candidate.

-

In top 10 cities.

-

In top 20 occupation.

3.3. Extra exploration: Positive Contribution

I started exploring subdata with positive contribution since it is the most important one.

## [1] 125565 4

## Error in file(con, "rb"): cannot open the connection

My data have 123,077 observatations with 4 selective variables. I want to look closer at box plots involving financial support and other variables. By limiting the y axis, the boxplot observation is better. Let start with candidate:

3.3a Financial Support vs Candidate Name

## target_pf$candidate_name: Clinton, Hillary Rodham

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.04 20.00 50.00 234.20 100.00 5400.00

## --------------------------------------------------------

## target_pf$candidate_name: Cruz, Rafael Edward 'Ted'

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.0 25.0 50.0 220.2 100.0 10800.0

## --------------------------------------------------------

## target_pf$candidate_name: Rubio, Marco

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 3.0 40.0 100.0 742.9 1000.0 5400.0

## --------------------------------------------------------

## target_pf$candidate_name: Sanders, Bernard

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.00 15.00 27.00 63.48 50.00 10000.00

## --------------------------------------------------------

## target_pf$candidate_name: Trump, Donald J.

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.8 28.0 50.0 211.7 160.0 5400.0

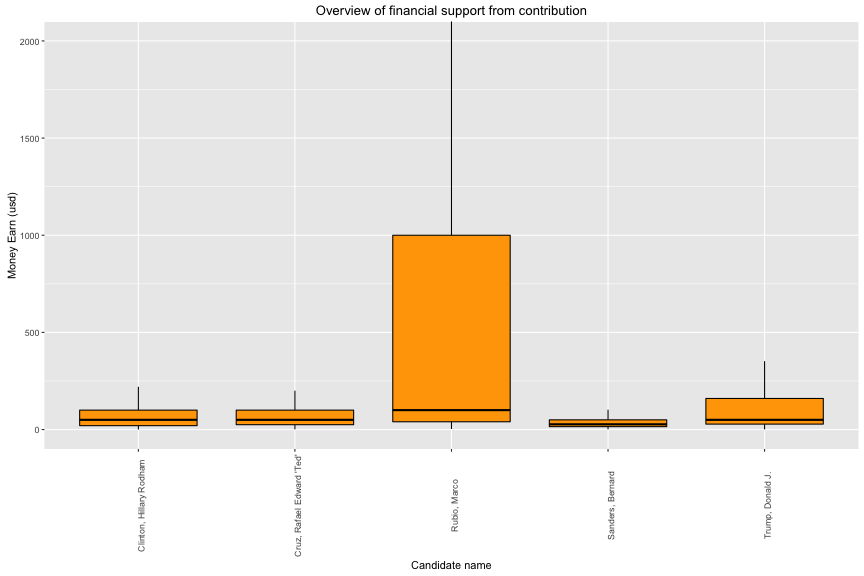

All of 5 candidates have non-normal distribution of financial supports. Therefore, using median value is better choice than using mean value. Marco Rubio has biggest median of positive support (median = 100) and Bernard Sanders has smallest one (median = 27).

3.3b. Financial Support vs Location

## target_pf$city: BERKELEY

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.000 20.000 50.000 140.097 100.000 2700.000

## --------------------------------------------------------

## target_pf$city: BEVERLY HILLS

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.640 27.000 100.000 566.626 500.000 10800.000

## --------------------------------------------------------

## target_pf$city: LOS ANGELES

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.160 18.550 35.000 204.181 100.000 10800.000

## --------------------------------------------------------

## target_pf$city: OAKLAND

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.4100 15.0000 35.0000 110.1563 100.0000 2700.0000

## --------------------------------------------------------

## target_pf$city: PALO ALTO

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.040 25.000 50.000 306.196 150.000 5000.000

## --------------------------------------------------------

## target_pf$city: SACRAMENTO

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.000 15.000 27.000 113.428 100.000 5400.000

## --------------------------------------------------------

## target_pf$city: SAN DIEGO

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.800 15.000 28.000 95.631 80.000 5400.000

## --------------------------------------------------------

## target_pf$city: SAN FRANCISCO

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.25 25.00 50.00 203.29 100.00 10000.00

## --------------------------------------------------------

## target_pf$city: SAN JOSE

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.000 10.000 27.000 82.061 50.000 5400.000

## --------------------------------------------------------

## target_pf$city: SANTA MONICA

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.650 19.000 38.000 220.999 100.000 5400.000

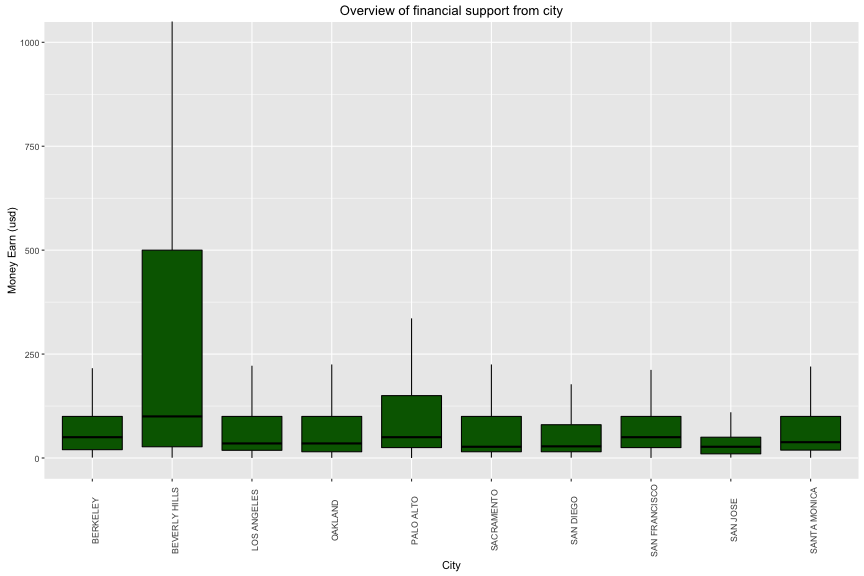

Most contributions (75%) from top 10 cities are varied from 18 to 100 usd. Beverly Hills is the city which has hightest median of contribution. Sacramento and San Jose are the least one.

3.3c Financial Support vs Occupation

## target_pf$occupation: ATTORNEY

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.160 25.000 50.000 292.647 200.000 5400.000

## --------------------------------------------------------

## target_pf$occupation: CEO

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.000 28.000 100.000 624.535 500.000 10800.000

## --------------------------------------------------------

## target_pf$occupation: CONSULTANT

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.330 19.000 50.000 224.553 100.000 5400.000

## --------------------------------------------------------

## target_pf$occupation: ENGINEER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.00 25.00 50.00 131.97 100.00 4000.00

## --------------------------------------------------------

## target_pf$occupation: EXECUTIVE

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1 38 100 472 250 5400

## --------------------------------------------------------

## target_pf$occupation: HOMEMAKER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.000 19.000 50.000 432.113 250.000 5400.000

## --------------------------------------------------------

## target_pf$occupation: INFORMATION REQUESTED

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.800 40.000 100.000 297.547 250.000 10800.000

## --------------------------------------------------------

## target_pf$occupation: INVESTOR

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.000 50.000 200.000 879.424 2500.000 5400.000

## --------------------------------------------------------

## target_pf$occupation: LAWYER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.000 25.000 67.640 315.084 250.000 5000.000

## --------------------------------------------------------

## target_pf$occupation: MANAGER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.0400 15.0000 27.0000 152.7112 100.0000 2700.0000

## --------------------------------------------------------

## target_pf$occupation: NOT EMPLOYED

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.000 15.000 27.000 65.533 50.000 5000.000

## --------------------------------------------------------

## target_pf$occupation: OWNER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.000 25.000 75.000 404.904 250.000 5400.000

## --------------------------------------------------------

## target_pf$occupation: PHYSICIAN

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.41 25.00 75.00 194.65 125.00 5400.00

## --------------------------------------------------------

## target_pf$occupation: PRESIDENT

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.000 25.000 100.000 582.351 500.000 5400.000

## --------------------------------------------------------

## target_pf$occupation: PROFESSOR

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.0000 21.0000 38.0000 140.5725 100.0000 2700.0000

## --------------------------------------------------------

## target_pf$occupation: REAL ESTATE

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.690 25.000 64.000 495.937 250.000 5400.000

## --------------------------------------------------------

## target_pf$occupation: RETIRED

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.390 16.550 28.445 126.453 100.000 8800.000

## --------------------------------------------------------

## target_pf$occupation: SOFTWARE ENGINEER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.000 19.000 38.225 104.432 100.000 4000.000

## --------------------------------------------------------

## target_pf$occupation: TEACHER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.0000 10.0000 25.0000 61.7222 50.0000 2700.0000

## --------------------------------------------------------

## target_pf$occupation: WRITER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.6400 15.0000 31.5000 190.8828 100.0000 3000.0000

In next catergory, the most contribution to American Election is from retire people with have more than 20 millions usd (median = 28.445 and the = 8800)

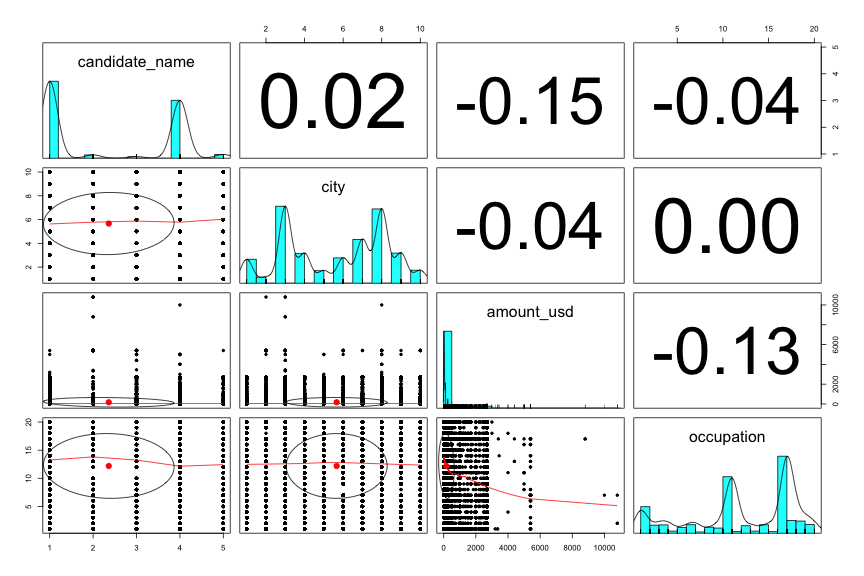

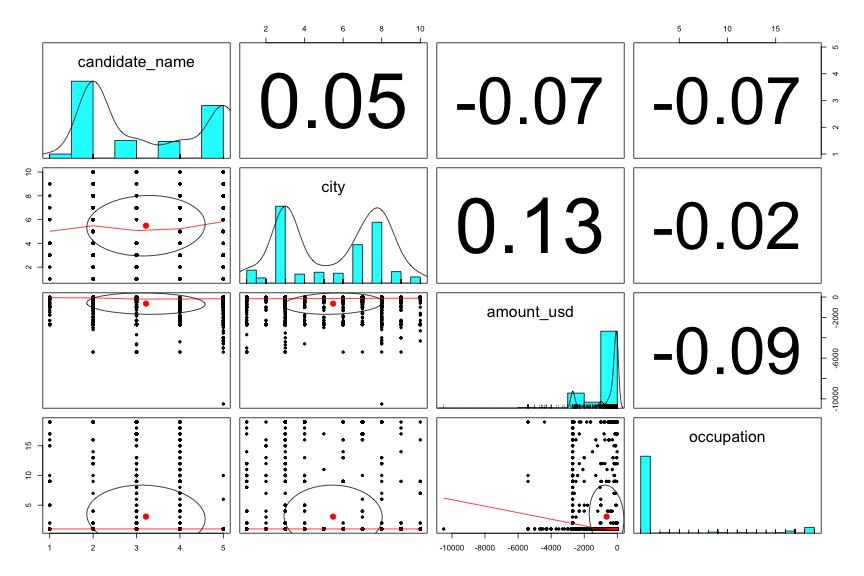

3.3d. Cross Correlation between features of interest

In general, the correlation between my interested variables are very low. The contribution is very diversed in city, occupation, employer and money to candidates.

###3.4. Extra exploration: Negative contribution

## [1] 2506 4

## Error in file(con, "rb"): cannot open the connection

3.4a. Financial Support vs Candidate Name

There are only 330 observations that satify my criteria.

## target_pf$candidate_name: Clinton, Hillary Rodham

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.04 20.00 50.00 234.20 100.00 5400.00

## --------------------------------------------------------

## target_pf$candidate_name: Cruz, Rafael Edward 'Ted'

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.0 25.0 50.0 220.2 100.0 10800.0

## --------------------------------------------------------

## target_pf$candidate_name: Rubio, Marco

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 3.0 40.0 100.0 742.9 1000.0 5400.0

## --------------------------------------------------------

## target_pf$candidate_name: Sanders, Bernard

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 1.00 15.00 27.00 63.48 50.00 10000.00

## --------------------------------------------------------

## target_pf$candidate_name: Trump, Donald J.

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.8 28.0 50.0 211.7 160.0 5400.0

Rubio has the largest range of losing money -500 to -2700 usd. Donal Trump has the shortest range of losing money.

3.4b. Financial Support vs Location

## target_pf_nega$city: BEVERLY HILLS

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -5400.000 -2700.000 -650.000 -1300.842 -54.430 -2.000

## --------------------------------------------------------

## target_pf_nega$city: IRVINE

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700.000 -2700.000 -300.000 -1131.091 -100.000 -25.000

## --------------------------------------------------------

## target_pf_nega$city: LOS ANGELES

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -5400.000 -755.250 -100.000 -657.504 -38.000 -0.240

## --------------------------------------------------------

## target_pf_nega$city: NEWPORT BEACH

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -4600.000 -2700.000 -500.000 -1214.513 -100.000 -1.000

## --------------------------------------------------------

## target_pf_nega$city: PALO ALTO

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -3000.0000 -500.0000 -125.0000 -586.4236 -50.0000 -5.0000

## --------------------------------------------------------

## target_pf_nega$city: PASADENA

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -5403.070 -2500.000 -400.000 -997.743 -50.000 -5.000

## --------------------------------------------------------

## target_pf_nega$city: SAN DIEGO

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -5400.000 -180.993 -50.000 -275.923 -35.750 -0.440

## --------------------------------------------------------

## target_pf_nega$city: SAN FRANCISCO

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -10500.000 -500.000 -100.000 -508.303 -25.000 -0.440

## --------------------------------------------------------

## target_pf_nega$city: SANTA MONICA

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -5400.000 -500.000 -188.075 -661.821 -38.000 -5.000

## --------------------------------------------------------

## target_pf_nega$city: SHERMAN OAKS

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -4315.000 -2700.000 -100.000 -1098.661 -36.000 -5.000

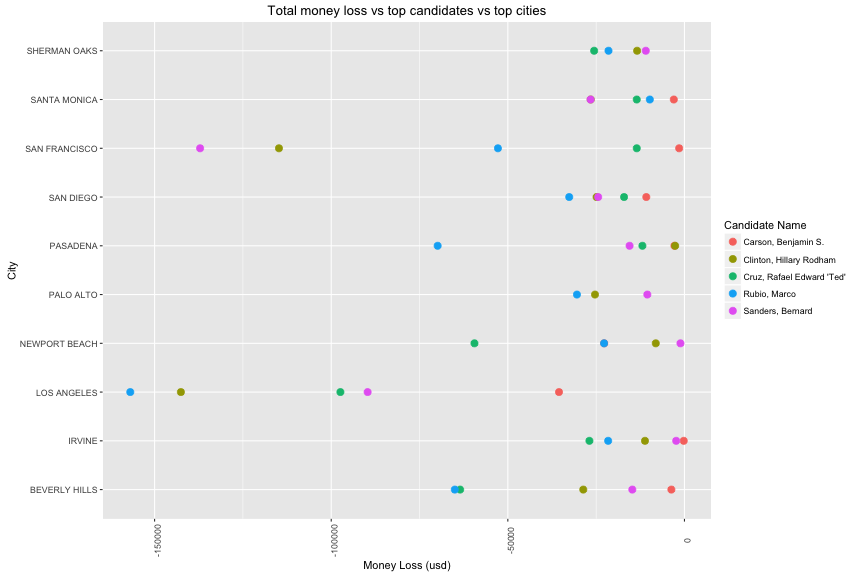

The city that have most money loss is Los Angeles with 700,000 usd (the median = -750, the max = -5,400)

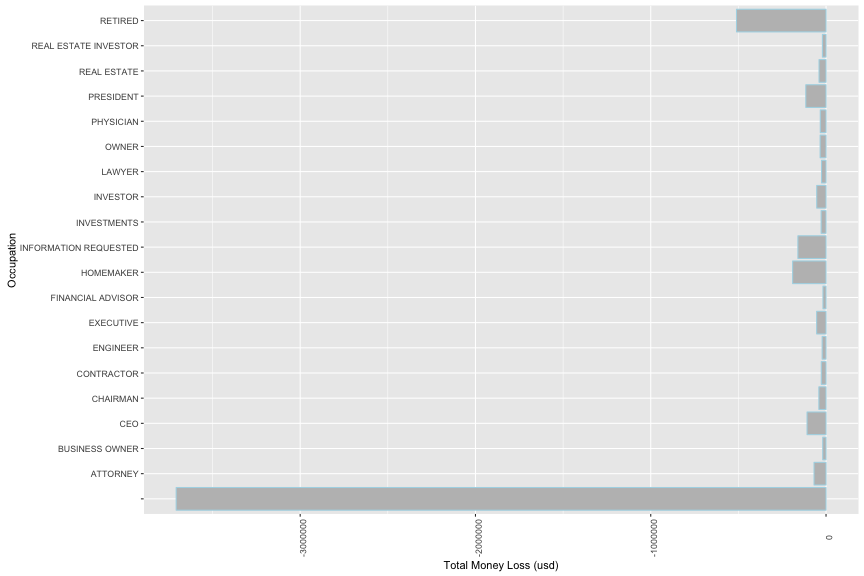

3.4c. Financial Support vs Occupation

## target_pf_nega$occupation:

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -10500.000 -500.000 -100.000 -565.349 -27.000 -0.440

## --------------------------------------------------------

## target_pf_nega$occupation: ATTORNEY

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700.000 -2700.000 -1020.000 -1414.171 -104.125 -11.450

## --------------------------------------------------------

## target_pf_nega$occupation: BUSINESS OWNER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700 -2650 -2600 -2600 -2550 -2500

## --------------------------------------------------------

## target_pf_nega$occupation: CEO

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700.00 -2700.00 -2300.00 -1806.25 -580.00 -300.00

## --------------------------------------------------------

## target_pf_nega$occupation: CHAIRMAN

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700 -2225 -1400 -1465 -1000 -50

## --------------------------------------------------------

## target_pf_nega$occupation: ENGINEER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700.000 -2700.000 -2700.000 -2133.333 -1850.000 -1000.000

## --------------------------------------------------------

## target_pf_nega$occupation: EXECUTIVE

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700.000 -2700.000 -2700.000 -1957.071 -1399.750 -100.000

## --------------------------------------------------------

## target_pf_nega$occupation: FINANCIAL ADVISOR

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700.000 -2700.000 -2700.000 -2146.667 -1870.000 -1040.000

## --------------------------------------------------------

## target_pf_nega$occupation: HOMEMAKER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -5400.0 -2700.0 -2700.0 -1835.0 -537.5 -30.0

## --------------------------------------------------------

## target_pf_nega$occupation: INFORMATION REQUESTED

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -5400.000 -2700.000 -2700.000 -2462.647 -2700.000 -165.000

## --------------------------------------------------------

## target_pf_nega$occupation: INVESTMENTS

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700 -2700 -2390 -1850 -985 -300

## --------------------------------------------------------

## target_pf_nega$occupation: INVESTOR

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700.000 -2500.000 -900.000 -1159.833 -135.375 -0.240

## --------------------------------------------------------

## target_pf_nega$occupation: LAWYER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700.000 -2700.000 -2000.000 -1408.711 -248.400 -30.000

## --------------------------------------------------------

## target_pf_nega$occupation: OWNER

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700.0 -2700.0 -2100.0 -1727.5 -1127.5 -10.0

## --------------------------------------------------------

## target_pf_nega$occupation: PHYSICIAN

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700.000 -2700.000 -1200.000 -1385.714 -150.000 -100.000

## --------------------------------------------------------

## target_pf_nega$occupation: PRESIDENT

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700.000 -2700.000 -1900.000 -1647.857 -505.000 -300.000

## --------------------------------------------------------

## target_pf_nega$occupation: REAL ESTATE

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700.0000 -75.0000 -50.0000 -411.8983 -50.0000 -7.0000

## --------------------------------------------------------

## target_pf_nega$occupation: REAL ESTATE INVESTOR

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -2700 -2700 -2700 -2700 -2700 -2700

## --------------------------------------------------------

## target_pf_nega$occupation: RETIRED

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## -5400.000 -500.000 -100.000 -645.571 -50.000 -1.000

The financial support is mostly reduced from people who has unknow occupation (median = 100, max = -10,500)

3.4d. Cross Correlation between features of interest

Similar to postive support exploration, I have very low correlation between features of interest.

4. Bivariate Analysis

Talk about some of the relationships you observed in this part of the investigation. How did the feature(s) of interest vary with other features in the dataset?

There is a high correlation between the number of contribution and the amount of money. Hence, a candidate needs to focus on gaining more contribution if he(she) want to increase his(her) election finance. In contrast, there is a risk of losing money when the number of contribution is also correlated to the amount of money loss. This pattern applies to candidate, cities and occupations.

Hilary Clinton is the one who earned biggest money in CA comparing to other candidates with ~ 80 millions and Marco Rubio is the one who lost biggest money in CA with ~ 1,5 millions.

In location, the financial support also depends on the size of city. It is clearly that the two biggest cities in CA have the highest amount of money for this American Election.

In occupation, the interesting point is that retire people contribute much money for American Election 2016. The variance of other features of interest hardly used to predict the financial contribution.

Did you observe any interesting relationships between the other features (not the main feature(s) of interest)?

There is no relationship between other features. It strongly depends on the trust of contributors during the election.

What was the strongest relationship you found?

The strongest relationship that can be found in my exploration is that the magnitude of financial support is strongly correlated with the number of contribution. It doesnot correlated with the social status or location of contributors.

5. Multivariate Plots Section

I applied the same approach as Extra Exploration by create two subset from raw data with following criteria:

-

In top 5 candidate.

-

In top 10 cities.

-

In top 20 occupation.

5.1. Positive Contribution

5.1a. Location

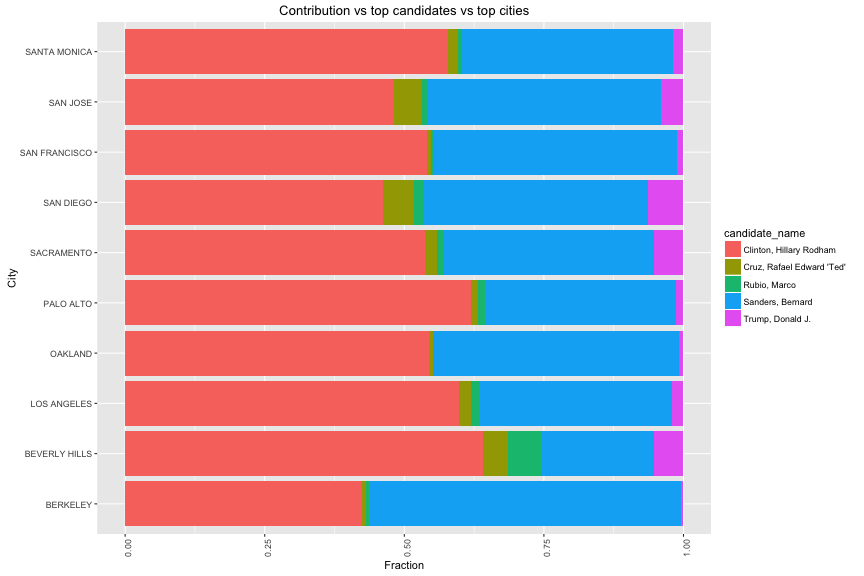

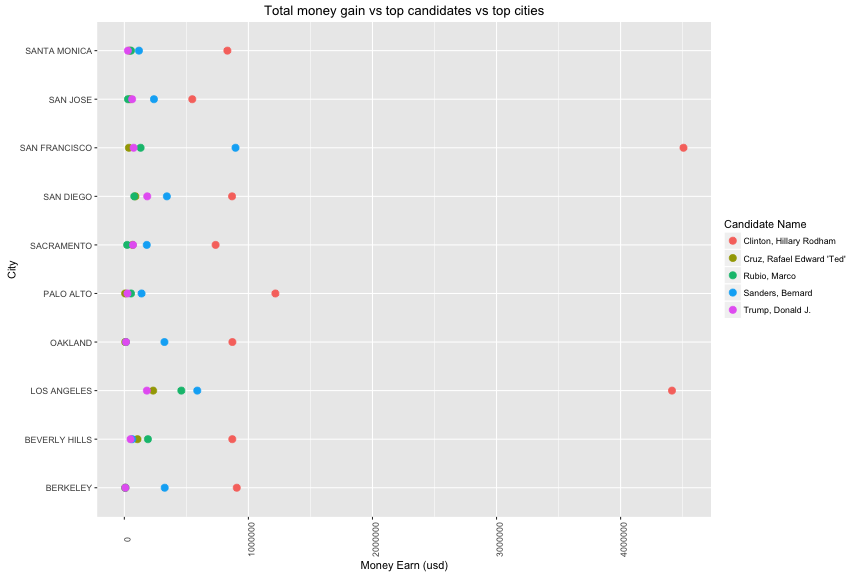

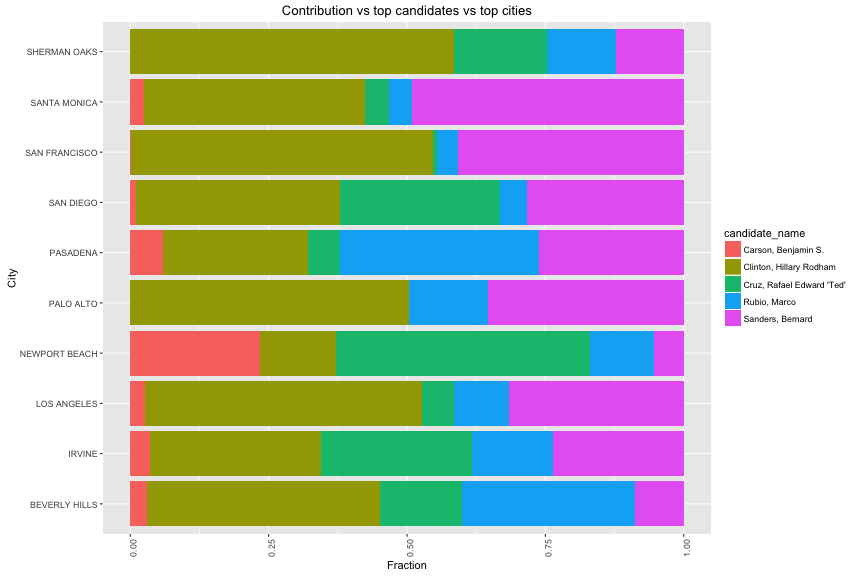

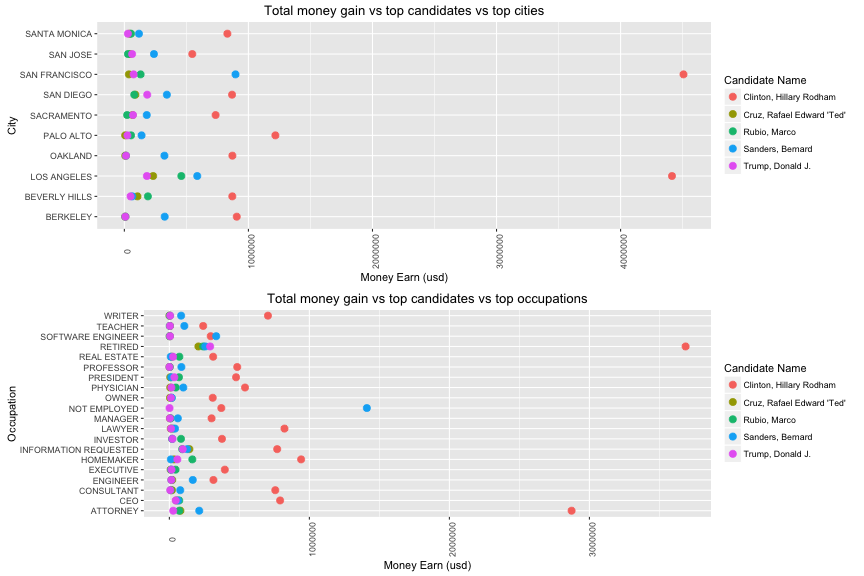

Hilary Clinton received more than 50% of support from 9 of 10 cities except Berkeley. People of Berkerly prefer Bernard Sanders.

5.1b. Occupation

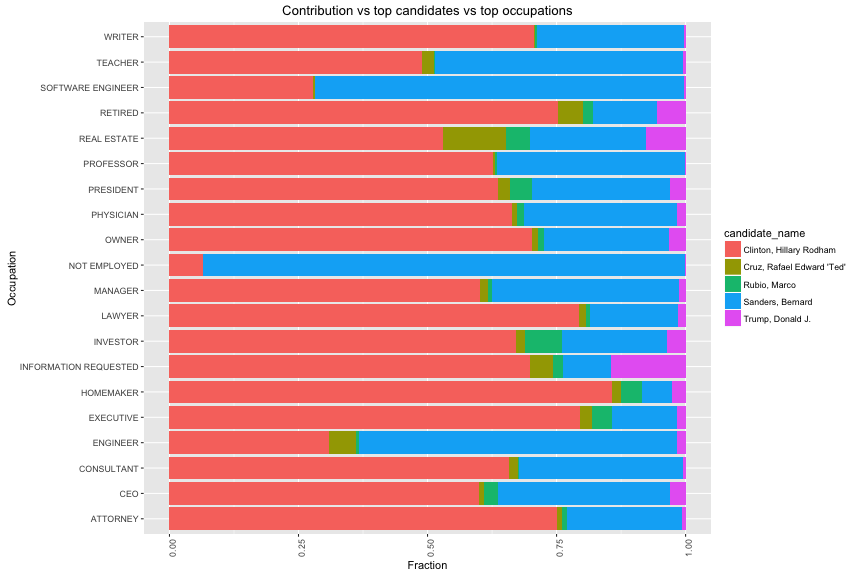

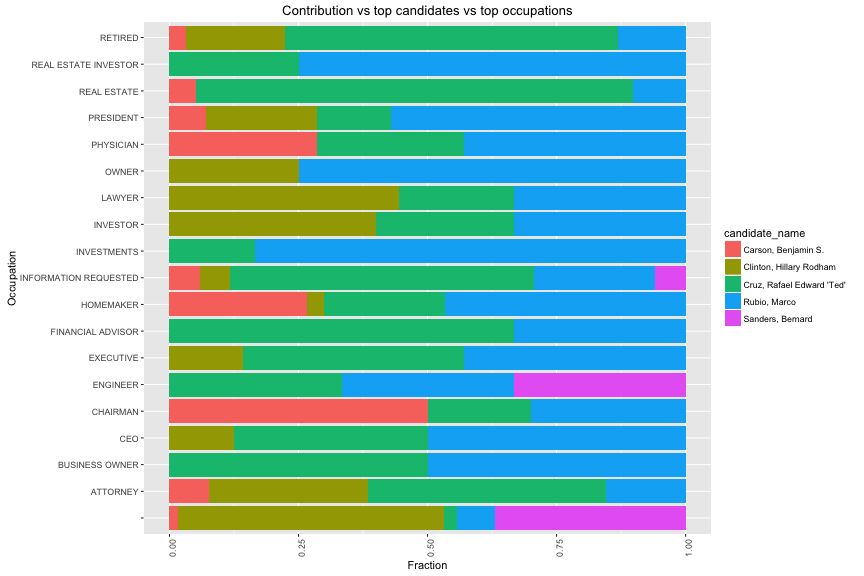

Let take a look to the faction distribution for each candidate in top 20 jobs.

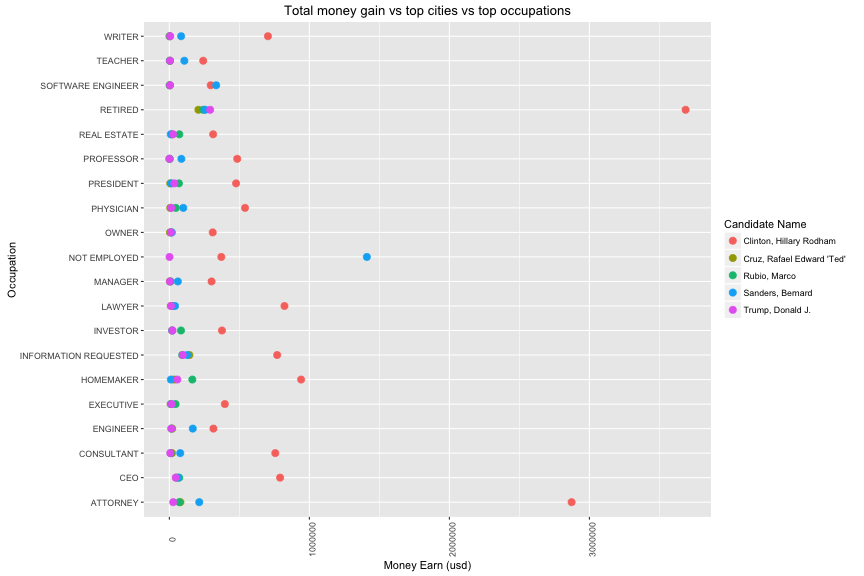

17 of 20 occupation have more than 50% of financial support to Hilary Clinton. Only NOT EMPLOYED and SOFTWARE ENGINEER have more than 50% of their support to Bernard Sanders. Top 1 contributor, retire people also voted for Hilary Clinton.

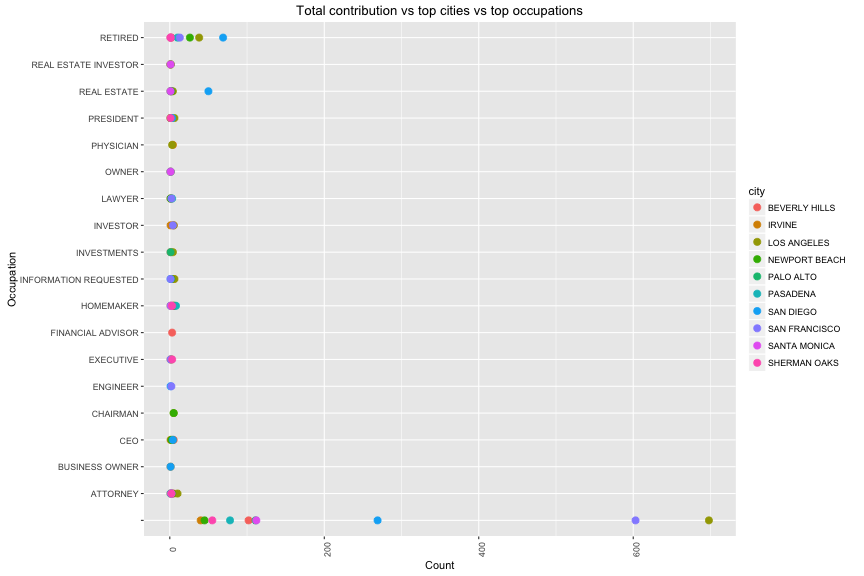

The graph above shows the number of contribution of each occupation in each cities. In all of occupation, Los Angeles is the city which has biggest number of contribution from retire people. The second place is from retire people in San Francisco.

5.2. Negative Contribution

5.2a. Location

Hilary Clinton (top 1 in positive contribution) received more than 50% of negative contribution in Oakland and San Francisco. Moreover, Marco Rubio is the one who lost biggest money in two largest cities: Los Angeles and San Francisco (6000 usd and 2000 usd respectively).

5.2b. Occupation

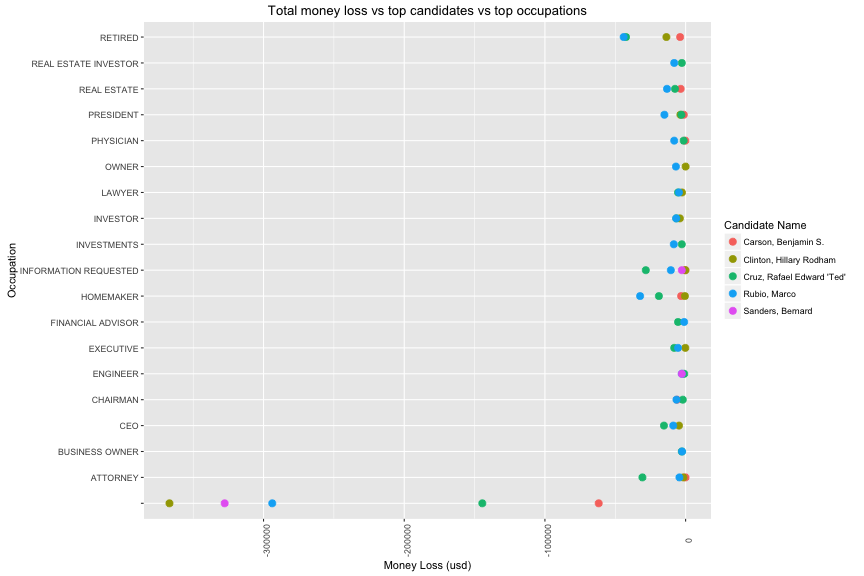

Obviously, Marco Rubio is the one who received the most number of negative contribution from top 20 opccupations. In group of unknow occupation, Hilary Clinton lost biggest money with ~ 400,000 usd.

In all of occupation, Los Angeles is the city which has biggest number of negative contribution from unknown people. The second place is from unknown people in San Francisco.

6. Multivariate Analysis

Talk about some of the relationships you observed in this part of the investigation. Were there features that strengthened each other in terms of looking at your feature(s) of interest?

The relationship in this part stated that the candidate who has large number of contribution, will have large financial support (ex: Hilary Clinton). This principle applied to other feature like location (cities) and social status (occupation).

Hilary Clinton won in getting financial support from all of top 10 cities in CA as well as top 20 occupation. The negative finance is varied and depends on candidate name in difference location and occupation.

Were there any interesting or surprising interactions between features?

I didnot see any suprising interactions between features because the number of contribution is the decisive factor to quantify those features of interest and the financial support is strongly related to this number.

7. Final Plots and Summary

Plot one

## Min. 1st Qu. Median Mean 3rd Qu. Max.

## 0.01 15.00 27.00 130.50 96.50 10800.00

Description one

The distribution of contribution per candidate is very skewed in California. The most favourite candidates are Hilary Clinton and Bernard Sanders with financial contribution > 400,000. Their contributions are 8 times larger than the rest. Additionally, it provides a good starting view to determine candidate’s finance in this state. The amount of contribution is very diversed. Its range mainly from 15 to 96 usd.

Plot two

Description Two

This is the most important plot when I easily observe the trending of financial support and the number of contribution. Clearly, the increase of contribution is correlated to the increase and decrease of money support for candidate (r > 0.90). In the other words, candidate who has large group of contributors will have high chance to get large money support and also have high risk to lose a considerable money. This relationship can be described in linear regression model. In conclusion, if candidates want to enlarge their Election funding, they need to make their group of contributors larger.

Plot three

Description three

These two plots prove that there is no variables of interest that affect money support beside number of contribution. Large city has large money support. Large group of occupation has large money support. The financial contribution for each candidate varied depend on the number of contribution from each cities and each occupation. It stated that the location or the social status is not a factor for changing money support. The size is the main factor. On the other hand, the interesting point is that no labor group (retired or not employed) contributed more money than labor group in this election. Finally, the building of a preditive model is not a good approach for this dataset.

8. Reflection

This financial contribution dataset contains information of more than 1 million observations across 19 variables in California from 2015 to 2016. In each individual variables, I started to select variable that helps me to answer my curiosity and leads to make observations on plots. At last, I explored the financial supports across the candidate, cities and occupation.

I encountered to the positive and negative number in financial report. If I didnot clean them, it would provide incorrect summary of financial support. Hence, I divided this dataset into two subset and did exploration. Moreover, I have categorical variables with more than 1000 factors. My solution is to limit those observations in top 5 candidates who have largest number of contributions in top 20 occupations and in top 10 cities.

There is a strong correlation between the number of contribution and the amount of money (both negative and positive side). There is no correlation between other categorical variables such as candidates, cities, occupations that I am interested. I struggled finding the relation between financial suports and other variables but this mystery is clearer when I realized that other variables are independent factors. So the relation is zero. In this exploration, I would like to provide the influence of candidates to cities and occupations by using the financial contribution. From that, we can estimate the chance of winner among those candidates during this American Election. Where is their strongest location ? Which people believe in their lead ? All those question can be answered by my plots.

However, my exploration has also limitations. Firstly, there is a duplication of money transactions from one unique contributor. Those contributors put money in and out of candidate funding by multiple times. Those activity makes outliers for the analysis and we get incorrect financial support for candidate per contributor. The good solution is making the financial summary of a unique contributor for every candidate. Because of lacking personal information (ex: date of birth, gender), I can not clean these errors correctly. Secondly, there is a group of unknow occupation. This is the intentional bias in which the contributors want to hide their info. This is one obstruction to clean this dataset. Thirdly, I only picked one state of America, it will underestimate the financial support of American Election. In further investigation, I prefer to use larger dataset including other states. Finally, I am not successful in making a predictive model based on categorical variables. That is the next thing I will do soon. The American Election 2016 was over so I hope to get a well-defined dataset.